A prediction about predictions

Why i'm focusing my efforts on Prediction markets.

TLDR section:

“Profiting from prediction markets will likely be my number one focus between now and November.”

I am a massive nerd who loves prediction markets.

If you’ve been following me on Twitter for any length of time, then you probably already know this because I shout loudly about them about once a week.

But because I’m incapable of condensing complicated things down into short form format, I’ve never really explained why outside of just blindly shouting, “AAAAA PREDICTION MARKETS YES AAAAAAAAAAAAAAAAAA.”

It’s unlikely I'll do much better in this essay because literally midway through writing this sentence, I got distracted to tweet angrily about the industry failing to attract normal human beings.

But anyway, the focus of this post is to explain why I love prediction markets and why they will likely be my number one focus for the remainder of the year.

The Betting market is ripe for disruption

Betting globally has been super fragmented.

Each country has different rules, regulations, markets, and interests. As a result, liquidity on betting sites has typically been very poor, and odds for the international markets have been very bad.

Traditional companies take crazy fees

Betfair, for example, bans half the world from using them but still has a market cap of 31 billion euros, probably because they offer poor odds on their Sportsbook, lure people into their casino, and take INSANE fees (between 5-10%) on their peer-to-peer exchange.

Betting sites aren’t nice to you if you’re good

If you are even a remotely profitable gambler or bet on events that have a chance of being positive EV, you will very, very quickly find your account “gubbed”—your bet size will be limited, all promotions will be stopped, and you may even have your account banned entirely.

This is an example of one of my betting accounts: I’m limited to £6.25 on horse racing and exactly £0 on the Premier League. If I had historically been a loss-making customer for them, they would let me bet far, far higher.

Funnily enough, though, on their p2p exchange where you bet against other customers, I can bet whatever amount I want. Here, they don’t care because they simply take a 5% fee from every bet.

Prediction markets have an opportunity to change all this

As you can probably tell, I’m not a big fan of the incumbent betting industry, and I would love nothing more than to see them displaced by new, innovative, fairer, more inclusive ways for us to lose all of our money betting on dumb stuff.

And I do honestly think some kind of permissionless, crypto-based, prediction market type solution will be the thing that does it.

The arena is ripe for innovation. You can bring down fees massively, you can finally have global markets, and liquidity can go up only because of the myriad of benefits permissionless markets bring.

It's a far better solution than lining the pockets of the industry titans that have bankrupted and contributed to the life-ruining gambling addictions that so many face.

It is an inherently fairer way of running markets.

AND the TAM is so big, today, despite having super fragmented, localised betting markets, many companies have reached huge multi-billion dollar valuations.

So when I start to imagine a world where a global competitor, offering fairly priced markets anywhere in the world emerges, my conviction that this category of products will onboard a huge wave of users and be immensely valuable increases.

So will it be Polymarket? Maybe? I’m not sure.

But the coming months will likely present us with a whole host of opportunities, and this is why it’ll be my main area of focus between now and the election.

Why do you think there will be opportunities in prediction market land?

I mentioned this in my "How to be less dumb" talk recently, but often in Crypto, there is an incorrect but strongly held perception that a large, vocal majority believe.

They parrot this perception wherever they go, which increases the number of people that think it, creating this weird death spiral of bad information.

Often, spending a few minutes questioning this narrative and looking at some data is all you need to disprove it.

In the case of Polymarket, this phenomenon rears its head once again.

Perception = Polymarket is super successful, so they must be making tons of money; therefore, they don’t need a token.

Reality = Polymarket is super successful, but they aren’t actually making money. They charge zero fees and pay LP incentives in USDC to the tune of around $6 million per year.

Now, of course, this is only one data point, and it’s not enough to base all your hopes and dreams on them doing a token just because they are currently not making a profit.

But it is an important data point when considering how over or under farmed an opportunity is. Generally, if no one believes a project will issue a token, then they won't bother spending five minutes looking at it or using it, so if you take the opposite side of that bet, your upside is typically far higher.

The sweet spot is finding projects that have higher mindshare with normal humans than airdrop farmers and focusing your efforts here. E.G. in the case of Polymarket I’ve seen more news sites post about Polymarkets impact in the world than i have seen threadooors talking about farming it.

SOME NUMBERS BACKING UP MY RANDOM BRAIN THOUGHTS

Polymarket peaked at around 45,000 monthly active traders, up massively since earlier this year.

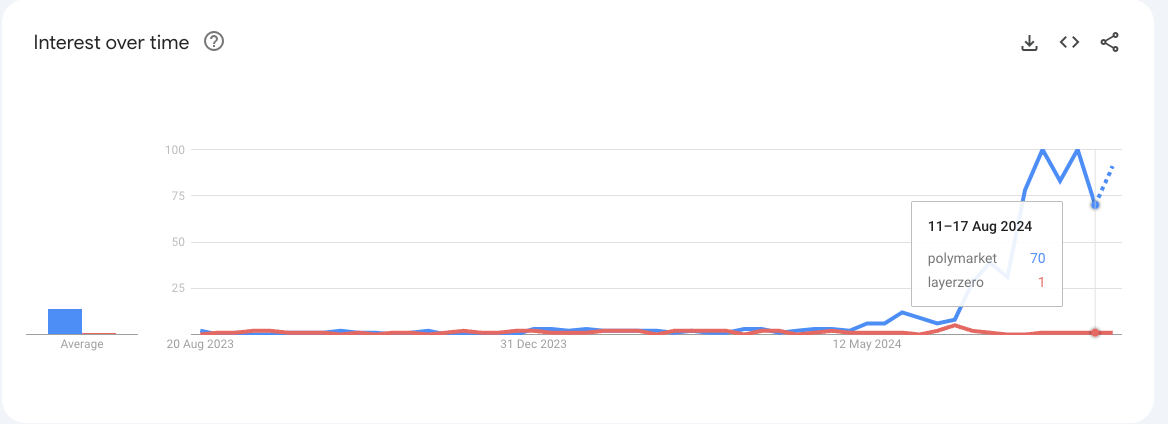

Whilst this sounds like a lot of users, it’s significantly less than Layer Zero, which was a hyper-farmed project where everyone knew a token was coming.

As a result, you end up with 5 million total wallets vs. 100k or so for Polymarket.

This tells me that there are 50x fewer farmers using Polymarket than L0.

And if we look at google search trends, we can see that Polymarket is clearly gaining a lot of mindshare in the world. Normal humans are searching for it. The same is not true of the most farmed project in the history of farmed projects - Layer Zero, where all of the attention around it was focused solely on the airdrop, not the product.

On top of this, Polymarket is far harder to “farm” than most other projects. This is because, to do volume, you must take some element of risk. You can’t just deposit some ETH in a contract on 25 wallets and wait three months; you have to BET on an outcome. Whilst you could, of course, just cover all sides to reduce your risk, unsophisticated users will drain their balance slowly here via the spread or become impatient and gamble anyway.

As a result, if there is even a slim chance Polymarket does a token, and you can find an edge on a particular market, it’s one of the biggest opportunities I’ve seen in years.

PLEASE GOD LET ME BE RIGHT I AM PRAYING PLEASE PLEASE PLEASE 🙏

Okay, so what if Polymarket never does a token? Isn’t this all just a waste of time?

Definitely not; the potential market size for the winning prediction market platform is insanely big and I’m certain there will be opportunities to do well along the way.

Polymarket has such a ginormous lead. Similar to Opensea in 2021. Nothing else comes close in terms of volume or mindshare. But because of this, they have a giant target on their back, and we’re starting to see good quality teams raising funds and starting to enter this market.

To be honest my internal odds for Polymarket doing a token are around 25% so please don’t get too carried away with my euphoria for the topic - I do just generally love this genre of product but I am not convinced they will actually do a token. The competitive landscape

Polymarket currently has zero fees.

Polymarket currently pays LPs in USDC from its $70 million+ warchest.

Therefore, competitors can’t undercut fees, and it’s unlikely they can match the USDC incentives because Polymarket has far greater funding.

Therefore, competitors will have to play catch-up to compete on two remaining factors: product or token incentives.

So if we assume these new competitors will emerge and will likely try to compete by incentivising betting in some way, then those that are experienced using Polymarket can benefit in a number of ways.

Teams may copy the NFT playbook and vampire attack, dropping tokens to Polymarket power users.

Users that are experienced on Polymarket can seek out inefficiencies in new competitors.

Increased competition and fragmented liquidity means arb opportunities may appear.

Professional tooling infrastructure is non-existent - the most profitable user on Polymarket’s leaderboard said in a podcast that he manually manages his trades. This means you are likely competing in an inefficient market, and where there is inefficiency, there is opportunity.

Chains themselves are heavily encouraging and incentivizing prediction markets to be built on them. It is likely that they will also look to incentivise users here too.

If you have spent time playing with prediction markets such as Polymarket, you will be well-placed to notice when a competitor is legitimately good, unique, and novel or offers far superior user experience and product. This will help you decide which competitors to focus your efforts on.

So overall, even if Polymarket opts to go the Opensea route and plans to IPO and I never receive any token incentives for using them, that’s fine. The experience and hopefully the profit made along the way by focusing on the inefficiencies, should make it more than worth my time.

And if the best-case scenario comes true, then I am putting in a few months’ work to ensure I am well-placed in the most hyped, yet oddly least farmed project of the year, and very well positioned to maximise the opportunity of all the competitors that spring up in the coming months.

Have a great week and remember, I am very dumb and always wrong and you shouldn’t listen to me.

NOT FINANCIAL OR GAMBLING ADVICE - IF YOU USE POLYMARKET, YOU WILL FIND YOURSELF STAYING UP UNTIL 6 AM CHEERING ON HILLARY CLINTON TO SAY THE WORD POKEMON IN A SPEECH AT AN EVENT YOU’VE NEVER HEARD OF BEFORE. YOUR WIFE WILL LEAVE YOU, AND YOU WILL HAVE TO JOIN THE OTHER ALCOHOLIC GAMBLERS WHO SPEND THEIR DAYS STANDING OUTSIDE OF THE LOCAL WILLIAM HILL BETTING SHOP ANNOYING PASSERS-BY ON THE STREET HOLDING AN 8% STRENGTH CAN OF HORRIBLE TASTING CIDER.

a big fan of prediction market, good read mate

very gud article!!