Blast

AAAAAAAAAA

This week, we saw the announcement of Blast.

As usual, Twitter went into a fit of rage, shouting at Mr. Pacman and calling him all different kinds of nasty things.

"This is a ponzi! It's a multisig! Lazarus will hack it! Why do we need another L2 anyway?! He killed NFTs! His hair is too much like Eminem's! He kicked my dog!"

Regardless of what you think of Blur and their newest project, Blast, you have to give Pacman some credit - he is an absolute master at designing incentive structures, and this is largely the reason why Blur was able to dethrone OpenSea.

Despite all the outrage on social media, the "bridge" now has half a billion dollars sitting in it and a further $200m in Blur staked, oh, and let's not forget there's also $100m in ETH being used for Bidding and Lending on Blur itself.

So in under a week, a team with a solid track record of delivery coupled with a new take on incentive structures has been able to attract close to a BILLION dollars, with half of that being locked for THREE MONTHS.

That's incredibly impressive and really makes me think Pacman is on track to become the main character as we enter into the bull market.

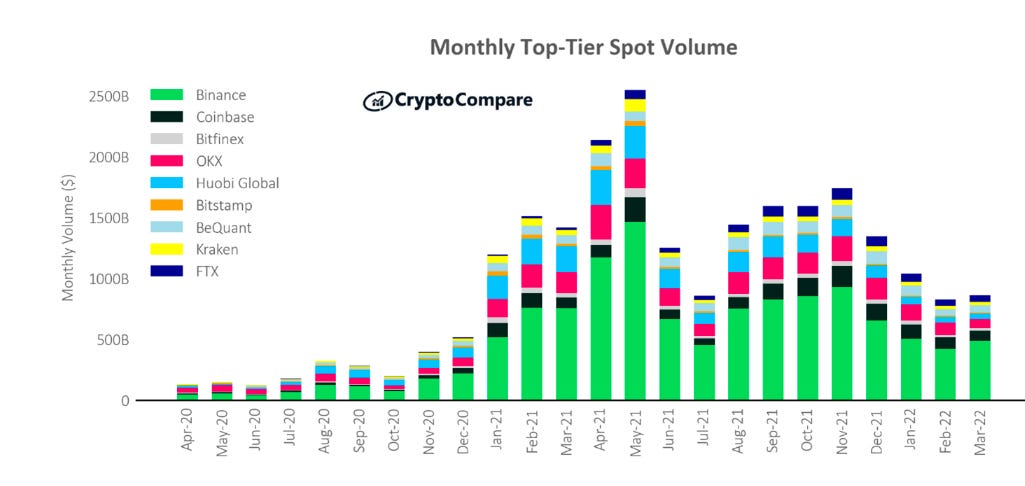

I was discussing this with a friend when I said that it's reminiscent of Binance vs Coinbase last bear market.

Binance went full growth mode, listing everything in sight with a lower regard for regulation or reputational impact, and as a result, experienced rapid growth.

Coinbase went, "Oh no! We can't list any non-pure assets that aren't Bitcoin or Eth; we might get told off," and thus lost a ton of market share.

Of course, we know how this story ends.

Binance gets hit by the DOJ years later, and CZ pays a big fine and has to step down, but the end result is the same. Binance is still the industry-leading CEX, and CZ is insanely rich. I doubt that would have been possible without taking some more risky decisions earlier on in the company's life.

Blast and Blur kind of feel the same to me.

Pacman arrived on the scene and absolutely decimated Opensea. Despite Opensea having hundreds more employees and a huge war chest of funds, they just couldn't match Blur for speed of delivery or strategic prowess; he was always three steps ahead.

If we look to the future about what he might disrupt next, well, it kind of might be everything.

Everything that's meaningful on Ethereum anyway.

First, I'd imagine he'll vampire attack the L2s, taking liquidity away from Arbitrum, Optimism, and Base. (I'm assuming the points leaderboards don't stop when the chain goes live; what if a new one appears that incentivises chain usage?)

Then the door is open to go after Lido. Well, with 245,000 ETH in the "bridge," that would put them fifth out of all the Liquid staking providers. Already significantly ahead of Coinbase ETH and Swell combined.

And then what about Maker? Probably the hardest one to vampire attack because of the regulatory element. But theoretically, there's no reason why in the future they couldn't purchase their own T-Bills and provide yield natively themselves.

If the Blur team is as ambitious as I think they are, then I'd imagine all of this is firmly within their game plan.

Either way, it sets us up for a super controversial but exciting year in 2024.

Now please note this is not an endorsement or recommendation of Blast at all.

I actually don't think the reward for farming it via depositing ETH or Blur is worth it considering the risks involved. Certainly not for any significant part of your portfolio anyway.

Assuming it comes out at a generous $4bn FDV with a 12% airdrop and 25% is given to ETH depositors. (my base assumptions) This results in about a 24% yield over the lockup period.

If you're a bit more bearish than this, then that yield forecast drops to about 6% at a $1BN FDV.

For most people hyperactive within crypto as we go into a bull market, I think it's likely that the ETH locked could generate a higher return farming alternative projects when we consider the risk profile of Blast.

It might not work, it might get delayed, it might attract regulatory attention, it might get hacked!

However, I personally will still be attempting to farm Blast.

But my personal strategy, and again this is not recommended because I am literally an idiot, is to use a portion of my ETH to farm by bidding and listing on NFTs.

I know for sure that the 100m or so used for bidding is not remotely efficient, and I've learned from months of doing this where the pockets exist that the whales miss, so it's certainly a more capital-efficient strategy.

I'm also predicting that the average attention span in crypto is that of a dog that's just seen a squirrel out of a car window. There is zero chance the farming velocity or excitement maintains over the next few months. Therefore, I think bidding will get significantly easier again as people move onto the new, shiny distracting, probably also hated thing that comes out next week.

I just plan to bid when the masses get distracted, consistently, over long periods of boring time, trusting in the process and hopefully in May I’m not broke, poor, and living in a Van because Pacman has been kidnapped by North Koreans.

But it does of course come with the risk of losing your Eth. You may get dumped on by angry NFT holders when it turns out their founder said something mean about a minority group on Facebook when he was 11 years old.

So anyway, and in summary. I think it's cool what Blur and Blast are doing; having the native gas token being yield-bearing makes a ton of sense and I'm excited to see it experimented with.

I have no real statement or point to make on the ethics of all this or their growth campaign, other than to say that it's clearly effective and I'd assume we will see more projects try to copy this. This isn't really a surprise; we've seen referral codes and points systems used in everything from Credit Card incentives to supermarket loyalty points; I'm sure this trend will continue.

The sad thing is, it's probably the beginning of the end of the period where a random user with a good brain can make six figures on each points-based airdrop.

I'd imagine within the next few years we start to race to the bottom as teams quickly start to find the equilibrium point at which they can drive consumer behaviour without giving out huge slippage in outsized rewards to smart players. Thankfully I think there's still a bit of time left for us to win.

Also!

I'd be very cautious of newer anon teams trying to replicate this. The risk profile isn't great as it's a new and untested concept and I'd doubt any clones have the same quality engineers that Blur and Blast do. So any copycats are a firm avoid from me.

Have a great Sunday!

Oh, and once again, DO NOT LISTEN TO ANYTHING I SAY I AM VERY STUPID. DO NOT BID ON MONKEY PICTURES THEY ARE LITERALLY JUST PICTURES OF MONKEYS DRAWN BY WHOEVER THEY COULD FIND ON THE INTERNET. IF YOU COPY ME YOU WILL SPEND THE REST OF YOUR LIFE LIVING IN A VAN AND EVERYONE YOU LOVE WILL LEAVE YOU.