Respawn Point

I'm rethinking mine

Do you remember life before autosave existed?

That presentation you worked so hard on. Lost because the computer crashed.

That job application you’d spent hours perfectly crafting. Gone because your power went out.

The spreadsheet your boss is demanding to see in twenty minutes. Gone because of a STUPID WINDOWS UPDATE YOU COULDN’T EVEN TURN OFF.

Your entire life savings and financial future…….. Gone because….

It’s funny, we’ve probably all suffered from the low-stakes examples of not saving our work.

We always think it won’t happen to us.

We’re caught up in the moment, engrossed in our jobs, then boom! At the most inconvenient time, the tech fails and you’re thrust into a pit of misery as you curse your past self for being a moron and not hitting save.

Thankfully, this is much less of an issue than it used to be. Most things just save automatically now.

But for those of us who work in crypto, we’re still living in the pre-autosave era.

If you make a mistake here, there is no turning back. No reboot function. If you sign a dodgy contract, or paste the wrong address, or fall in love with an attractive woman who is actually a North Korean male, you can’t just reboot the app and start again. No. Everything you’ve worked for is gone.

In a bull market, the risk of this happening is even greater.

All logic flies out the window.

You see your friends making life-changing wealth copy trading someone called “Bonk Guy.”

Strangers on the internet you have a parasocial relationship with are posting screenshots of wallets with millions of dollars in them.

Stuff is going up. Dumb stuff is going up more. Your Uber driver tells you this is his last day on the job because XRP is going to $100.

Everyone around you is taking risk. Maybe you should take more risk too?

Then, before you know it, your life savings are stored in 20x leveraged perps positions and Moonbirds. Your pension has been converted into a Cardano treasury company and you’ve quit your job to doomscroll Twitter and argue with your other unemployed friends on Telegram.

Of course, these are massively exaggerated examples, but the trend is often very real. If you’ve existed in crypto for any prolonged period of time, it’s likely happened to you. You’ve woken up one day and realised, what the hell am I doing? Why do I have my annual salary in Zerobro?

Ultimately, we are still just monkeys wearing clothes. We act on emotion and badly optimised instincts. We are designed to live in the woods and to climb trees and stuff - not to trade complex derivative products we don’t understand on rectangular boxes of doom.

But the good thing about humans is that we do have part of our brain that's rational. Part of our brain that can plan. Part of our brain that is capable, sometimes, of taking a step back from the dopamine machine gun and thinking more than three seconds into the future.

Image from the amazing Tim Urban on his post about procrastination

We just have to actively make a choice to put down Twitter, breathe for a few seconds, and switch the rational decision-maker part of the brain on.

On the rare occasion I accomplish this, I like to use this brief period of clarity to figure out where my respawn point is.

What's a respawn point?

In gaming, a respawn point - or a checkpoint, as it’s often called, is the place you start again from after you have died.

The reason games have these is because it would be incredibly frustrating to spend six hours playing, only to be defeated by a difficult boss near the end and then be forced to restart the entire thing from the beginning.

But often, in finance and investing, we find ourselves doing just that. Continuing along, playing the game, never once taking a second to think about where we’d end up if something bad happened.

As readers of this blog will know, in crypto, bad stuff happens all the time.

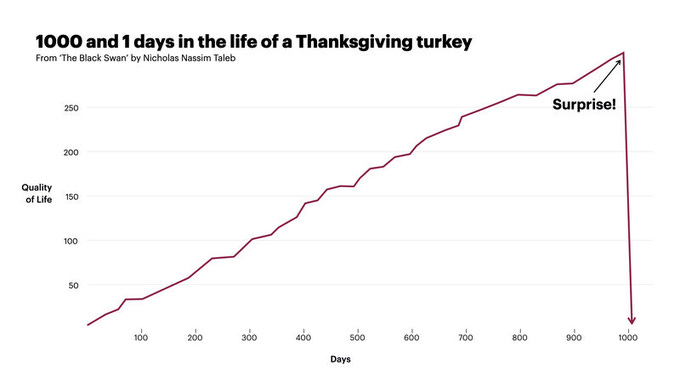

Just as we start to feel safe, something insane happens. We’re used to black swans. We’ve lived through FTX. We’ve had bank accounts closed. We’ve seen our friends get hacked. We’ve seen projects we believed in go to zero. We’ve seen Coinbase gift wrap and hand-deliver our personal data to crooks.

So if you haven’t already, it might be a useful exercise to sit down at your computer, open a spreadsheet, and calculate where you’d financially respawn if something tragic happened.

Imagine one day Satoshi awoke from the dead like some kind of angry Bitcoin Jesus, FSH’d all his coins whilst screaming THIS WAS NOT MY VISION!!

Ask yourself the following:

What would happen to my portfolio?

How long would it take me to get back to where I am now?

Would my life be entirely ruined?

Would my wife leave me?

Am I okay with this?

Even if you’ve been here a while and think you know what you’re doing - all it takes is one misstep, one wrong click, one black swan, one quantum computing innovation, one war, and it’ll happen to you too.

From Taleb - Turkeys have a great life, until one day, it's suddenly all over

Where should my respawn point be?

I guess this is where someone who wears a suit to work would tell you that this is all extremely obvious and you should just have a balanced portfolio instead of your entire net worth in Fartcoin.

But if you’ve somehow stumbled upon my Twitter page, it’s highly unlikely you’re the kind of person who would be capable of following this advice.

Your respawn point should be highly personal to you.

Don’t listen to internet strangers, influencers, people in suits, and especially not me.

Maybe your respawn point is having some of your wealth in global all-world index funds?

Maybe it’s moving Bitcoin out of your hot wallet, setting up multisigs, and putting some into IBIT?

Maybe it’s getting a better job, a promotion, or starting a business with multiple streams of income?

Maybe it’s having six months' expenses in cash in the bank, paying off your mortgage, and getting a second residency or passport?

Maybe it’s investing in the casino, rather than continually gambling in them?

Maybe it’s prepping a bug-out bag, hoarding tins of tuna, antibiotics, lighters, and tradable objects so you can survive a full-blown civil war?

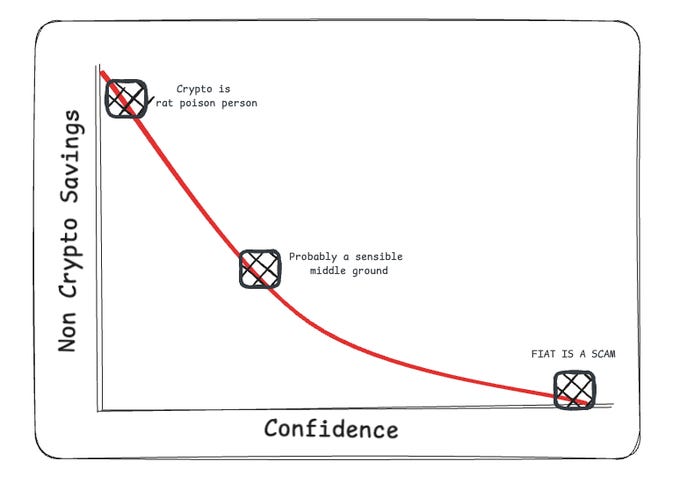

Maybe you actually have the opposite problem — your respawn point is already too high, and you’re not actually taking enough risk?!

Essentially, what it boils down to is your personal level of risk tolerance, how anxious you are, and how much you trust in your abilities to make it all back from zero if the worst happened.

Part of why I'm writing this post is because I've been reconsidering my own respawn point.

For the past four or five years, crypto has provided bailout after bailout opportunity, so more risk-taking has arguably been the optimal strategy.

Bitcoin has gone to zero and back many times.

Projects have airdropped billions of dollars. Random speculative manias have taken place in all areas of the industry. Anyone with basic pattern recognition skills and some discipline could have used terrible risk practices, gone to zero, and made most of it back many times over.

But sadly, I think this is no longer the case. We are no longer early.

I doubt you’ll get the chance to buy Bitcoin again at a 90% discount.

Now that ICOs are seemingly legal, are teams going to continue handing you free money? Or are they going to sell you stuff instead?

If crypto is a legitimate industry, it should — in theory — become more efficient. And if it is more efficient, it may become harder for bedroom-dwelling keyboard warriors like me to find and maintain an edge.

So my plan is to hedge against my own stupidity and move my respawn point a little bit closer to where I sit right now.

Because the worst part of losing it all isn’t actually losing it all. It’s realising that you could have survived it.

SORRY FOR BEING A DOOMER BUT AS USUAL DO NOT LISTEN TO ME I DONT THINK I EVEN OWN A SUIT ANYMORE MAYBE BITCOIN GOES UP MAYBE IT GOES DOWN MAYBE EARTH GETS HIT BY A METEOR AND ALL THIS INTERNET MONEY STUFF IS STUPID AND ALL THAT REALLY MATTERS IS HOW MUCH OUR FRIENDS AND FAMILIES LOVE US AND BY WORRYING ABOUT WEALTH WE'RE LETTING THE YEARS PASS US BY AND YOU WILL LOOK BACK ON THIS MOMENT ON YOUR DEATH BED AND CURSE THE DAY YOU SPENT READING BLOGS BY A HOMELESS DOG ON THE INTERNET WHEN YOU COULD HAVE BEEN ASKING YOUR WIFE HOW HER DAY WAS AND THEN MAYBE SHE WOULDNT HAVE LEFT YOU FOR JERRY FROM THE TENNIS CLUB.