The airdrop guide for dumb people

Airdrop farming is for life, not just for the day after the last one.

In the world of Crypto, there are an infinite number of traps that dumb people, such as myself can fall into if we’re not careful.

There are badly designed user interface traps where it's possible to accidentally burn your $100,000 picture of a punk instead of wrapping it.

There are user error traps. It's easy to send Eth to an exchange from an L2 instead of an L1 and have to beg and plead with them for months to return your money.

There are FOMO-induced traps, whereby in a race to win a gas war for the third iteration of a goblin picture, you accidentally type 5,000gwei instead of 50 and instantly sacrifice 1 ETH to Lord Vitalik.

But the biggest trap of all is foregoing your ability to think critically and blindly following the advice of people with a larger follower count than yourself.

One area where I see this often is users assuming that Twitter threads or Discord Groups that write guides on how to receive airdrops for a particular project are gospel.

There are a number of problems with these types of threads.

These threads usually only appear or gain traction in the days after the latest big airdrop, not at the time they are actually relevant. It’s all well and good having detailed instructions on how to transact on Zk Sync, but that's not particularly useful if the snapshot was taken six months ago.

The people with some of the highest engagement threads or videos are more likely to be created by content creation specialists than expert researchers or traders. It’s more likely they are attempting to monetize your attention rather than provide you with actionable information.

It’s in the interest of every chain or dApp to remove sybilers, and with thousands of users all following the exact same guides/processes/orders of operation, it's pretty easy for these platforms to either design the incentives away from this or simply remove these users entirely. These guides tell you to interact in the exact way a sybil farm would.

So, how can we, despite our inferior intellect, ensure that we are on the receiving end of future airdrops?

Consistently receiving airdrops is not one time thing, you can’t complete it in ten minutes. It’s a process, or a life-style that touches upon every interaction you do in crypto.

This is not a guide on how to receive any one particular airdrop. It is instead a repeatable process that I try to follow to ensure that I’m ahead of the curve and have provided true value to projects way before any airdrop snapshot and months before the threaders start telling everyone how to do it.

Remember, I am not a wizard. I cannot see the future. I have no idea if any project I mention here will airdrop or steal your coins and flee to Montenegro. Do not take anything here as financial advice or endorsements for any projects. This is Crypto. Basically, everything is currently terrible, clunky, broken, or error-prone. If you do not wish to lose all of your money, you should stop reading right here.

Step 1 - Understand the reasons why a project might wish to airdrop tokens

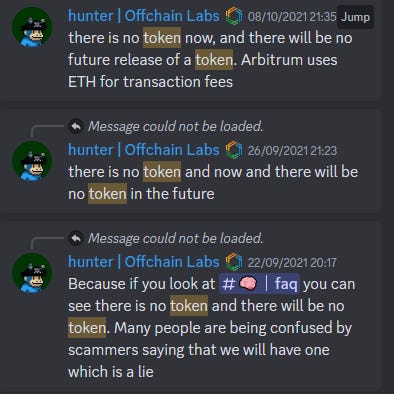

Despite many projects claiming that they have no intention to launch a token, the truth is often the opposite of this.

Source: Arbitrum Discord - 1.5 years ago the Arbitrum team was adamant there would be no token ever.

Even if they are completely honest at the time of making the statement, the game theory involved means that over time, the likelihood of them choosing to proactively launch a token or being forced to deploy one defensively increases.

Let's consider some of the reasons why a project might be incentivized to offer a token and to whom they might wish to award it.

Crypto's ethos is built around community ownership and decentralization. A token is fitting with this culture.

Projects want to attract new users, and launching a token is perceived as a good incentive to acquire them.

Protocols worry about the US government protecting their citizens by randomly suing projects for no reason. Handing over control to community ownership lets founders sleep easier at night.

Investors may subconsciously or inadvertently pressure teams to release a token so that they can pretend to their LPs that their four-year locked tokens with 5% circulating supply and $20bn FDV are in profit.

A new project may use a token to capture market share from an incumbent market leader that does not currently have a token.

L1s/L2s want to attract the top dApps to their chain and may wish to bribe them into launching with them.

Projects want to attract legitimate users with both influence and economic power. They do not want to attract Sybil farmers or rent-seeking users and will seek to reward the former and weed out the latter.

For now, it's clear that the majority of projects will issue a token at some point. The incentives right now are clearly in your favour and are likely to remain this way until projects discover a smarter way of attracting users that retains them greater wealth without risking getting a visit from the regulators.

The competition for these airdrops is also farcical when you consider the amount of money at stake.

The average crypto user has an attention span shorter than a Neuralink chimpanzee that's had nothing but TikTok content delivered directly into its brain since birth.

Airdrops over the past few years have literally been the easiest money you could ever possibly earn, and yet people still can't even sit down for an hour and contemplate how they can get more of them.

Step 2 - Determine the projects

Once you grasp the possible incentives and understand why projects issue tokens, you can plan which projects to focus on. Picking the right projects is crucial, given your limited time and resources.

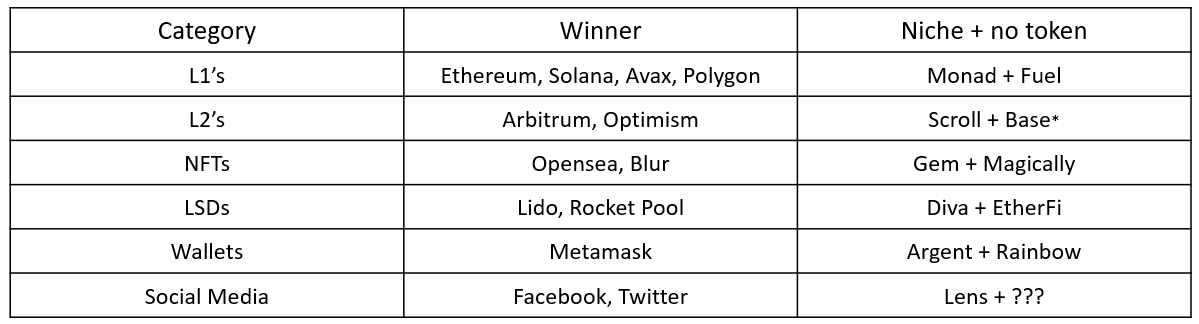

Cobie's article, "Tokens in the Attention Economy," uses a brilliant model to portray the types of projects.

Maximum profit is made when you select the projects that currently exist in the niche category but eventually move up to become winners.

The same is true when selecting the airdrops to focus on. Typically, airdrops are retroactive, and users who are early to niche projects are often the ones most heavily rewarded.

For example, Blur was relatively obscure to most crypto users outside of die-hard NFT traders in the early days. As a result, it was easy to be early and secure a large airdrop.

Post-airdrop, Blur became incredibly popular, flipping Opensea in daily volume and swiftly moving from niche into the winners' category. As a result, competition for Airdrop two quickly became incredibly crowded as thousands more users fought over a smaller number of tokens.

This isn't to say you shouldn't focus on projects within the winners' category. By nature of already being winners, their tokens should hold significant value. However, the competition for these tokens is far fiercer.

For example, Opensea or Metamask, if they ever airdrop, will be valuable but likely dispersed to hundreds of thousands of users, resulting in a lower per-user $ value distributed than projects in the niche category.

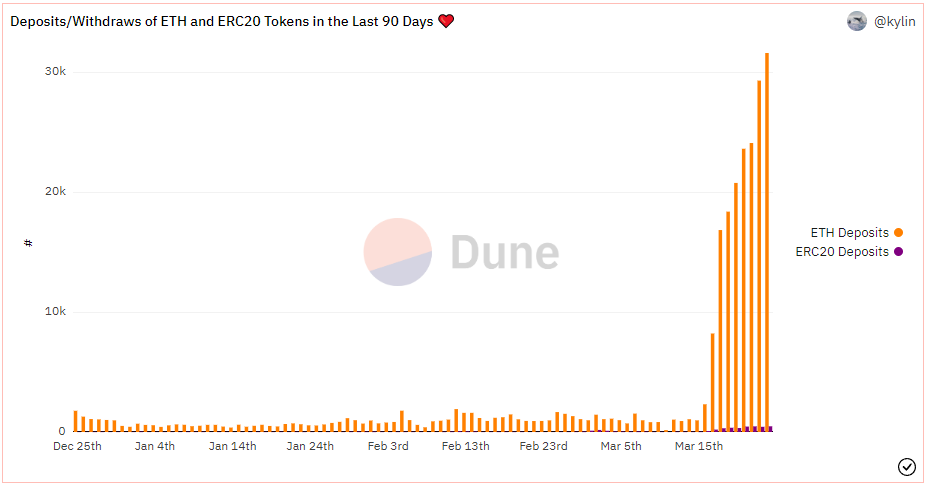

A live example of this playing out in real time is just after Arbitrum announced their airdrop. Deposits into Zk Sync exploded as threadoooors told everyone this was the way to secure generational wealth.

Source: Dune @Kylin

While Zk Sync will likely be a very valuable network, it is still a very crowded trade. The time to bridge and transact was probably a year ago when they first launched. Right now, you'll likely have to think outside of the box to differentiate yourself from the bots.

If we think back to the incentives, it's unlikely an L2 wants to attract hundreds of thousands of probably fake users all depositing 0.01 eth, swapping twice and never using it again.

A quick search for some Dune Dashboards will show you the typical bot-like behaviour that is taking place. Just avoid doing what the crowd is doing and you’ll likely be okay.

Source: Dune @Kylin

In the same week, a number of freshly funded projects that have raised millions in the past few months hosted Twitter spaces or Discord calls with under 100 attendees.

Each of these projects has upcoming narratives that could shine and issued actionable information about their next steps. I would classify these types of projects in the niche category that have the potential to one day become winners.

If you wait for confirmation they are winners before using them, maybe at that point it's too late, and the snapshot has been taken.

It's worth mentioning that the same was true in the previous cycle. I remember attending a Cowswap community call with under 20 participants around the time everyone was FOMOing over a possible Paraswap airdrop because the YouTubers were shouting about it. Cowswap was worth thousands, and we all remember how the Paraswap one went!

Okay, so how do we actually determine which projects are Niche but good?

The easiest way to determine which projects are in the obscure but good category is to simply try out every project that piques your interest. If you are open-minded, you will be able to suss out which projects are just here to make some quick money and move on and which are building revolutionary game-changing products.

The added benefit of trying things out yourself and coming to your own conclusions is that it allows you to quickly realize which well-known Twitter personalities are actually knowledgeable and which are just farming your attention.

It's likely you'll learn that Twitter follower count or number of YouTube views does not equal alpha. If they are blindly shilling a project that you've used and know is of poor quality, you can assume their next recommendation may not be so great.

Similarly, if you notice a user who is consistently providing information that aligns with your real user experience, it gives you a green light to check out other projects they've mentioned, and you can set up an alpha pipeline.

When you spot multiple users who have consistently shown good judgment all aligning on one project, bingo, you're onto a goldmine here.

It's also essential to be able to determine which projects are in the obscure and rekt bucket, this will save you a lot of time and energy.

If you blindly follow others' guidance, you'll find yourself spending a week of your life joining hundreds of Discords in an attempt to farm the Collabland airdrop because a Mutant Ape PFP told you it would be worth the same as Blur. REKT.

A table you can recreate for every conceivable category

*Whilst Base is not niche from a brand recognition point of view, it is niche in the sense that most people believe it will never have a token.

The examples I've given above are just a few of the projects that I'm currently researching or trading. These fall into the niche category and have yet to launch a token. Perhaps some of these will turn out to be this year's Blur or DyDx?

Don’t just blindly follow my list

I'm just a random person who spent three minutes putting it together. It's far from complete and lacks nuance that I'm too lazy to explain.

Instead, do your own research, find projects that interest you, and scour Defillama to discover every new project that's recently raised money. Then ask yourself, "Is this actually something that could be good?" Join their Discord, ask questions, and decide for yourself if the team seems competent. Are there hoards of people asking for the token's release date? That's probably a bad sign. Do you have to retweet 15 things on Twitter to gain entry? Run away.

If the project's premise sounds promising, the team is smart and focused, and their primary marketing strategy isn't to use you as a promotional guinea pig, jot it down, add it to your personal list, and figure out a way to stay involved.

Focus the bulk of your project list on your specific skillset

Are you a gigabrain DeFi researcher? It might make sense to concentrate on niche lending protocols or order book Dexes where you maybe have an edge.

A monkey picture extraordinaire trader? Perhaps focus on NFT platforms, but try them out on other L1s / L2s to cover more ground. Ordinals would be a good example of a niche area with enormous potential and high barriers to entry because it's new and confusing.

None of the above but good at considering narratives? Write down every major product launch or Ethereum update coming in the next twelve months and determine when similar tranches go live. ZK technology, LSD post Shanghai, Wallet upgrades post EIP-4337. If you know that in three months a new trend might appear as a result of an upgrade or catalyst, scour the interwebs to find the best suited projects to capitalise on these trends without tokens and TRY THEM OUT!!!

Step 3 - Determine the win-wins

It’s likely that when designing their airdrop allocation, projects wish to reward users who have provided legitimate value to them. As a result, determining where both the project can win, and where you can too as a by-product (regardless of token or not) is the best way of increasing your chances of receiving free money at some unspecified future date.

Below are just a handful of examples that I thought up quickly. I'm sure that the readers of this blog, who are far smarter than me, could conjure up many superior strategies.

Eth Staking:

Let's say Shanghai passes by without a hitch, and Eth is freely flowing in and out of staking platforms. You have all your Eth staked with Lido but want to diversify to help Ethereum decentralize and reduce your counterparty risk.

In this scenario, you could stake a portion of your Eth with one of the newer LSD projects, provided that you have researched it thoroughly and are comfortable with the risks involved.

You win by diversifying your holdings, and they win by increasing the number of unique users staking with them. An airdrop is an added bonus.

Alternatively, if you don't trust anyone else in the world except Lido to secure your precious eth, what about holding it on a chain that is likely to offer incentives?

As shown below, by holding your WstETH on Optimism, you will receive free OP tokens. I'm sure that as the battle heats up and chains fight for apps to deploy with them, more of this behaviour will take place.

Social Media Posting

If you are a social media enjoyoooor who likes using the thread and downward-pointing finger emoji, you might benefit from including some of the newer Web 3 social media apps into your influencing schedule.

While you might not get the dopamine hit of being called an environmental terrorist by a cartoon furry when you post a picture of your latest NFT on these platforms, you do get the benefit of having less competition for attention.

I'd wager that the user base is tailored towards inquisitive and forward-thinking individuals. As a result, there’s always a chance that you may find some alpha or actionable information on these platforms, or maybe your threads will stand out and people will reach out to you to join a community of like-minded smart individuals.

By acting in your own self-interest and using these platforms, both parties win, and the project itself gets to brag about its ever-increasing user metrics.

And maybe, in the future, projects like Lens will gain significant traction, and they may opt to reward genuine early users who have built followings on these platforms. This could result in free money for you at best, and at worst, you get to try out a new platform.

Govoooooorning

Projects want to look good in front of Mr Gensler, so they pray each night that their tokens are actually used for governance so they can pretend they are not speculation devices when the SEC sends them a scary sounding letter.

For this reason, participating in governance is a win-win situation for you. (I know this may sound boring, but bear with me.)

Reading governance forums can actually provide a tremendous amount of alpha. It is usually free from the typical dramatised engagement farming you see on Twitter, so you get some level of intellectual stimulation, and it is possible to find information here long before it appears in your Discord chat group.

Both parties win if you use your tokens to vote, and in the future, projects may reward these activities retroactively by offering voters free tokens. We've already seen this happen with Optimism, both for eligibility in airdrop one and again in airdrop two.

Not everything you do in pursuit of an airdrop will always work out, so it's best to try and design your time around the win-wins. Even if the project crashes and burns and never rewards you, how can you still learn something from it or profit as part of your normal trading behaviour?

Step 4 - Determine the optimal route of travel.

As you go about your on-chain life, there are times where you need to carry out an action without a direct profit motive.

Maybe you need to send your funds back to L1 after losing half your money gambling on Dog tokens on Arbitrum.

Or maybe you want to set up a new set of wallets on a second device, so when you illegally stream that Champions League football match, your tokens don’t pay for a new North Korean missile system.

In these scenarios, it pays to think for a second about how these simple transactions could result in you benefiting in the future. In the first scenario, maybe you usually use Hop as your go-to bridge. You probably do this because it was the first one you ever used, and it was convenient. But ask yourself, why are you still using it? Is it the best? Is it rewarding me? Am I learning something new by using it?

If the answer to all of those questions is a negative one, then consider trying something new, or if you want to be super safe, use something older but trusted that still has a possible reward structure.

An example here is Stargate, although Stargate has a token, the underlying tech platform Layer Zero does not. While there is no token confirmed yet, you can speculate that the $135m investors poured into the company will at some point be looking for a return, and maybe Bridgers fit into that equation somehow too?

In the second scenario, where you are wisely using the Horcrux approach to protect your crypto from nefarious actors, the typical user would opt immediately to install another MetaMask extension on their new device. But if we think for a second, why is it that we are doing this?

It’s likely because that's what everyone else uses and what we’ve always done.

But is MetaMask the best option?

I personally can’t answer that because I too am very dumb and have never used anything else.

Maybe other wallets that exist out there today are way better? Or if not, some of the new ones that are being built right now since EIP 4337 was activated are likely to be a significant improvement over the tech we have today. So maybe it's time to give them a try?

Worst case, by spreading my assets across multiple wallets, I reduce my total loss if something goes badly wrong and I learn about the competition.

Best case, I never get hacked, I find a way better wallet than MetaMask, and suddenly because one new wallet drops a token, all are incentivized too, and I’m heavily rewarded for my experimentation.

** If I were in charge of a wallet project, I would certainly be considering ways to dethrone MetaMask's monopoly, and a token would be up there on my list of considerations. **

Step 5 - Trade on chain as you normally would, but using protocols you list in step 2.

Example: You are an NFT trader who believes that Pudgy Penguins are the future. You would buy this NFT anyway without incentives because you believe the price will go up.

Consider: In step two, you noted that Gem has heavily hinted at a token and is actively tracking activity on its marketplace, and that Blur is rewarding people for listing.

With this information, the optimal thing to do is:

Step 1: Buy the Pudgy Penguin using Gem.

Step 2: List the Pudgy Penguin using Blur.

Step 3: Pray you are not a complete idiot and Pudgy Penguins do not go straight to zero.

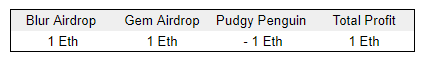

One month later, you capitulate your Pudgy Penguin for a 1 Eth loss because unfortunately, they were not the future of Finance.

Three months later, Blur airdrops you 3,000 tokens. You swap these for 1 Eth.

Three months after that, Gem finally can convince Opensea to let it issue a token, and it kindly provides you with 3,000. You swap these for a further 1 Eth.

Despite you being dumb and making a bad trade on the Pudgy Penguin, because of the steps carried out above, you were saved by the kindness of the win-win incentives this industry enables and were able to flee with a 1 eth profit.

The above steps are repeatable if you are a token trader, Defi Yield Farmer, or user in just about any category that exists in Crypto, tailor all of your activity towards your listed projects, try not to go broke, be patient and wait.

Summary

Step 1: Understand the incentives and learn why a project might consider a token

Step 2: Do your research, find the projects you like and write them down

Step 3: Consider how both you and the project can win as a result of your actions

Step 4: Determine the optimal route of travel in each interaction

Step 5: Trade as normal but prioritise projects noted in step two

If you've made it this far through my incoherent ramblings, chances are you are already on the way to making it.

The biggest barrier to wealth, in my opinion, is your attention span. If you can make it out of the dopamine-fueled treadmill of Twitter, unlock your brain's creativity, sit still at a computer for a few hours a week, and follow a very, very basic plan, I'd wager you'll make six figures this year with ease.

Think critically, develop a plan, use as many things as you possibly can out of genuine curiosity, not simply in pursuit of free money. Think before you act and ensure that no transaction is wasted, and you will supercharge your trades while giving you some room for a buffer on your losing ones.

Stay hungry, and remember, the incentives are always in your favour. The tokens are coming, but they might not come for months. Make sure you're prepared now so you can collect them in the future.

Have a great weekend.