The Rise and Fall of Blur Farming

A Saga of Bids, Points, and Losses

With around two weeks to go until the theoretical end of double Blur points, I thought it would be interesting to review the landscape and provide an update on how I see the world of Blur farming.

Since Airdrop one, a number of things have happened.

Blur bidding went from being a highly profitable activity, mostly ignored by the active NFT community, to suddenly every known person in the universe bidding above floor price for pictures of cartoon penguins they absolutely did not want to own.

The demand for Blur bid points quickly became greater than the demand for the NFTs themselves. That, of course, led to an unsustainable market structure, and predictably, many people got rekt as long-term NFT holders took their opportunity to dump their positions on the heads of these makeshift market makers.

Whilst this was taking place, the price of the Blur token tumbled, the NFT market went down only, whilst the price of ETH continued to rise, and the Blur points system encouraged people to keep gambling. It was a perfect cocktail of ways to lose your money.

However, amidst this chaos, a rebalancing took place

In the past few weeks, it's evident that the exuberance has waned and the crowd has started to shift.

Blur increased the double points period for another month - this led to a reduction in the number of users bidding (down to 14 points for top 500 from the 20’s).

Machi - who was consistently at the top of the leaderboard and keeping prices elevated appears to have tapped out with over 2,000 eth of losses.

Franklin - who was also high in the leaderboards - has also capitulated, stopping bidding and yeeted his apes that made him famous.

NFT volumes have declined massively since the post-airdrop FOMO in February.

OpenSea has hit back by rebranding Gem to OpenSea Pro, and some core airdrop farmers have switched allegiances.

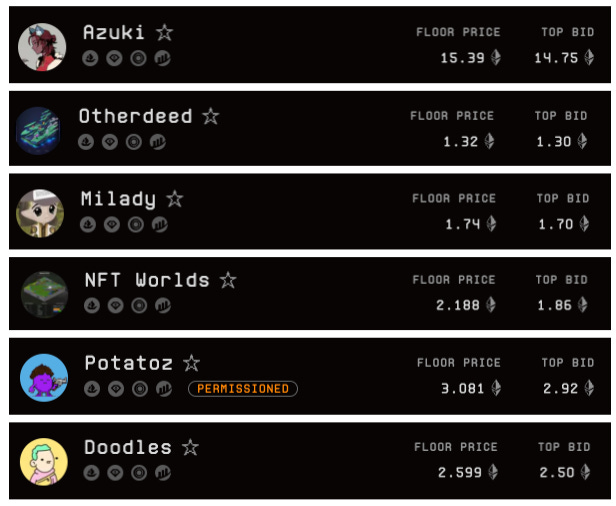

The result of these shifts is notable in the marketplace. A few weeks ago, the bid and ask were usually identical on most collections in the top 20. Liquidity was abundant, and there was no real spread for patient traders to profit from.

In fact, on many occasions, I profitably purchased NFTs using Gem for below the bid price, waited an hour, and then sold into the bids for a profit because people were blindly bidding ABOVE FLOOR in order to attain points.

The situation looks a bit different now.

The bid and ask for popular collections look far healthier, and at times significant gaps open up.

All of this indicates that the hype for Blur points has started to cool, and you could arguably make a case for bidding being viable again.

Strategies to Lose Less Money

Whilst bidding has captured all of the headlines over the past few months, as usual, CT is only focusing on a small part of the whole story.

This shows in the data too, as a large portion of the Blur maxi farmer bidders are either not thinking strategically or are incapable of using their eyes and brains to read things.

Two areas, in my opinion, are being largely ignored both in the collective narrative and the quantifiable actions users are taking:

Loyalty and Listings.

Loyalty

Blur made it very clear back in February that the way to maximizing rewards is via loyalty. Users with the highest levels of loyalty have the greatest chances of receiving the highest tier of care packages and thus receive the most tokens.

Reading between the lines here, it's also a method in which they can reward users with lower quantities of ETH with higher rewards.

So, with this information, you’d expect that the leaderboard would be filled with 100% loyalty as everyone farming bid points has certainly digested this information and taken it into account, right?

Evidently this is not the case.

With 25% of the leaderboard scoring literally 0% for loyalty, it's clear to see that not everyone is focusing on it, and an opportunity exists here.

Even Franklin, who has farmed points fairly heavily, has 0 NFTs listed on Blur.

I’d wager that outside the top 500, things are significantly worse as these are likely people not fully focused on the airdrop and probably co-listing things on Opensea. Or they have their settings set to seven-day listings, meaning that even if they think they are being loyal to Blur, their listings are likely no longer live after seven days, and they’re scoring 0%.

Listings

The second area that is being largely ignored is listings. I wrote about this in some detail in my post - "A Diary of Distractions," so check that out for the full version.

To summarize though, listing points in season two are worth as much as bidding points, but hardly anyone talks about them, probably because there is no giant leaderboard telling them to.

As a result, what I’ve noticed is that the ratio of bids to listings is hugely skewed.

When I very nerdily manually counted a few weeks ago, here were some numbers:

Within 0.05 of the floor:

Opepen - 17,000 bids, 88 listings

Lil Pudgys - 14,000 bids, 75 listings

Otherdeed - 10,000 bids, 100 listings

Sappy Seals - 6,000 bids, 30 listings

Pudgy Present - 6,000 bids, 27 listings

Cool Cats - 3,000 bids, 12 listings

Maybe I’m overthinking this, but one side of the trade seems awfully crowded, while the other might just be being ignored.

Is Blur even worth farming?

The honest answer is that it truly depends on your individual circumstances, so giving a one-size-fits-all response here would be intellectually dishonest. But for me personally, I’m back in the arena and giving it a try, and I’ve tried to determine some possible outcomes.

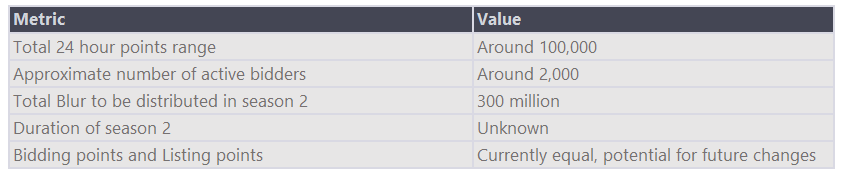

Season two will not be anywhere near as profitable as season one, but taking a daily snapshot of the top 500 over a number of weeks, the total 24-hour points range seems to fluctuate around 80,000.

As the leaderboard is very top-heavy, this can give us a good indication of how many total points are up for grabs each day.

Recently I scored 1 point and was 1702nd, so you can reasonably assume there are maybe 2,000 accounts actively bidding on a daily basis.

If we are ultra-generous and say all 2,000 of these accounts average 12 points per day (typically the low of the scoreboard), this only adds an extra 18,000 points to the total.

Therefore, we can reasonably assume that 100,000 points per day is the upper limit for points distributed.

Additional criteria to consider:

Using this data, we can begin to draw up a range of outcomes depending on the length of the promotion. If we assume that these are the following scenarios:

Optimistic scenario: runs for 100 days, with daily points halving for the remaining 30 days.

Mid range scenario: runs for 180 days, with daily points halving for 90 of the days.

Pessimistic scenario: runs for 320 days, with daily points halving for 200 of the days.

DOOM scenario: runs for 320 days, but Blur launches a second initiative that is worth double phase one.

This results in the following:

Using the table above, you can estimate how much Blur you are likely to receive based on the points you currently have. It's likely that if you have good loyalty, these estimates will be on the low end as the calculation hasn't accounted for that.

You will also receive bonus points if you have been listing, but without the guidelines being published, it's difficult to quantify what they might be. My base assumption is that if you have been listing with similar frequency to bidding, you will end up with more total points because fewer users are listing.

Summary:

In summary, Blur bidding is still a long way off from the glory days of the money printer that was season one.

There are small pockets where you can give yourself a boost by listing and remaining loyal, and if you are skilled at NFT trading its an area where you can boost your profits.

However, overall, it's hard for me to recommend Blur bidding to the average user. The current NFT marketplace environment is still tough, with prices trending down. If you are not an experienced or confident trader there’s a good chance you can lose money bidding.

Have a great weekend.

great read!