This week has been a BLUR

A case for increased liquidity in the NFT ecosystem

This week, I decided to take a break from odd-sounding acronyms and instead dive into the world of colourful and fun images.

For some baffling reason, people value these combinations of pixels at extraordinary sums, with NFTs changing hands multiple times per day at sportscar-level valuations.

But the fun thing about NFTs is that it is one of the least sophisticated, efficient, and liquid markets on the internet, and with that comes huge opportunities for those who dare to look.

It is at this point, I must again remind you that nothing I say here is financial advice. You absolutely should not be reading the blog of someone on Twitter with 3 followers and making financial decisions, especially when those decisions involve buying pictures of monkeys for the same price as a university education.

NFTs have been around for ages and are way down, why are you talking about them now?

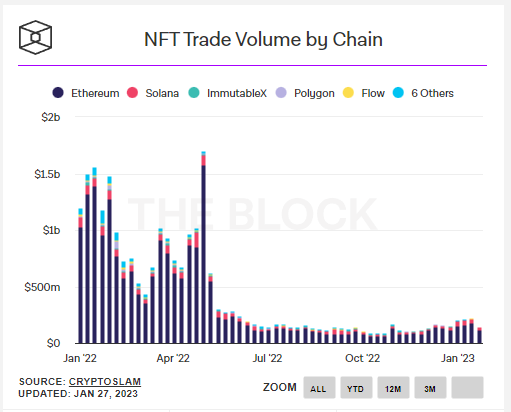

Source: The Block

NFTs, when looking at a volume chart, do appear to be very dead compared to the craziness and stupidity we saw in 2021 and early 2022.

However, the past two months have started to show an uptick in volume, with OpenSea showing almost a 100% increase in the past 30 days.

Source: Dappradar

Part of the reason for this increase in volume is due to the rapid growth of new NFT platform Blur.

Blur targets the type of trader who cares more about profits than the colour of their penguin's jumper, and as such has seen over 50,000 traders try out the platform.

Naysayers at this point may claim that these are all bots or wash traders trying to farm Blur's upcoming airdrop.

While there may be some truth to this, as a user who has been using Blur for the past month or so, having to go back to using OpenSea is like being taken out of a fancy new Tesla and thrust into an old rusty van and being told to drive it at speed, with a broken arm, while blindfolded.

And if you're lucky enough to make it out alive, you're charged 2.5% for the privilege.

You said the word airdrop, what about the airdrop?

An interesting cultural phenomenon I've noticed in Crypto is that when projects are upfront about their airdrop terms and how to receive it, they are often met with scepticism.

As a result, they are often under-focused on, as for some baffling reason, people seem more excited to farm a possible Arbitrum airdrop with 100s of thousands of bots than use a bit of effort to generate a guaranteed airdrop such as Blur.

A similar thing happened with DyDx, and it was amusing to watch as users blamed everyone but themselves for their reasons in missing out on thousands of dollars for a few minutes of work.

The reasons I believe Blur is being under-focused on is:

anecdotal evidence, such as numerous NFT discords proclaiming the Blur airdrop already worthless

Blur is in 167th position for TVL (Total Value Locked) with $35m, battling it up with world-famous BabyDogeSwap and ioTube.

Source: DefiLlama

While $35m is certainly a significant amount of money, it is relatively small when compared to the billions currently deployed in leading DeFi platforms such as Lido, Curve, and Uniswap. If the NFT market has the same potential value as DeFi, then it could be argued that there is a significant opportunity for growth in this area.

Another indication of this potential is the fact that over the past 30 days, Blur has been the 7th highest gas user on Ethereum.

This suggests that there is a high level of activity and interest in the platform, which could indicate a growing demand for NFTs and a potential for liquidity in the market.

Source: TokenTerminal

So whats next for the NFT market?

My prediction, is that once the Airdrop takes place, we will actually see an increase in the liquidity on Blur.

Blurs founder Pacman stated in a recent interview with Token Terminal that their key goals are to maximise the user experience and to only ever incentivise liquidity, not volume.

This suggests that the platform may encourage users to participate in liquidity provision and bidding in order to earn more tokens.

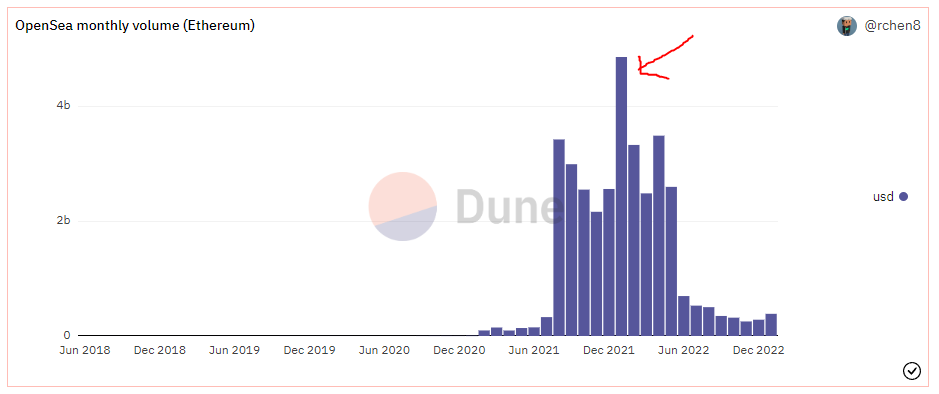

The last time we saw an NFT marketplace drop a token was LooksRare, and it happened to co-incide with the highest Opensea volume month – January 2021.

Whether this was all down to the LooksRare and x2y2 airdrop is subjective, but when you give free money to NFT traders, it stands to reason that a portion of that will be re-invested back into NFTs.

Source: @rchen8 Dune Dashboard

If the same holds true this year, and the Blur airdrop is of significant size, I believe we could see increased volumes in the NFT marketplace, at least throughout the month of February.

Summary

In summary, finally we are starting to see significant improvements in NFT infrastructure. This should in theory lead to higher liquidity in the market, at least over the coming months. With greater liquidity this opens up the possibility of increased volumes as traders are able to enter positions with more confidence and exit them faster.