Why Stablecoins will change the world

Trillions

As someone who works full time in crypto, I often find myself telling white lies to people to explain what I do for a job.

If I told them I pretend to be a homeless crying dog who writes words on the internet and invests in make-believe money, they would think I’m insane.

But sometimes, my relationship with crypto slips out.

In the majority of cases this leads to an open-minded conversation where I can explain a bit about the space and dispel some of the myths.

But on one particular occasion, someone who has clearly been infected with a mind virus hears about what I do and launches a tirade about how crypto is worthless, and it’s going to zero and I should leave before it's too late.

"You closed-minded idiot, crypto is good, learn to think for yourself”

Is what I wanted to say.

But because the person saying it was my girlfriend's best friend's husband, I had to be tactful, so I didn’t end up actually homeless and alone in real life too.

So what I really said was:

“Well, outside of Bitcoin, there is an entire industry that is making life better for people around the world who don’t have stable banking infrastructure, who have volatile currencies, an unstable rule of law, or maybe are experiencing hyperinflation.

That industry is stablecoins.

And in many first-world countries with our luxury banking apps, our stable currencies and our forgotten memories of all the tyranny that took place in our great grandparents' generation, we have truly forgotten that life can be extremely hard, and self sovereignty and having the ability to store value in times of uncertainty is exceptionally important.”

building with blocks of worthless notes during hyperinflation

At the time it was just me searching for a good-sounding reason to stop the conversation moving on to FTX, or Bitcoin destroying the planet, or NFT traders murdering all the dolphins or something.

But the more I think about it, the more evident it becomes that alongside Bitcoin, stablecoins are one of the most important innovations in all of financial history.

Even if you live in a developed country with democratic elections and where the legal system is only slightly corrupt, there’s a reasonable chance you’ve been screwed over in some way by the banking industry.

Cypriots, for example, who lost up to 94% of their euro savings when their banks got into financial trouble.

Or maybe you’re a British person being stopped from withdrawing cash from your bank account without sufficient evidence for where the money is being spent.

Or an American Coinbase user who has had their account frozen for months as they bang their head against a wall talking to customer support.

Or you simply work for an international company and have to make seventeen phone calls each week to determine if the money you sent via traditional rails has arrived or not.

Stablecoins, whilst not perfect, and with their own unique set of risks, do offer, in many circumstances, huge benefits over traditional payment and banking methods.

And tbh it's testament to their pmf that they’ve managed to survive in a political climate where Boomer government employees who get paid six figures to give 12-minute talks at banks were trying to get them shut down.

But thankfully, the people in command, at least in America anyway, are starting to realise, hold on a minute, these stablecoin things are actually pretty important.

And being able to export the US dollar globally in a far more efficient way probs increases the likelihood of retaining the privilege of being the world's reserve currency.

Tether is already the seventh largest buyer of US treasuries, and buys more than the great nation of Canada, home of outdoor survival expert Adam Cochran.

So we’re in this weird situation, where we have this miracle tool (stablecoins) that allow anyone on earth to keep assets safe from a tyrannical government, hold wealth in a stable asset stored in their brain whilst also massively reducing cost and complexity for business AND bringing instantaneous payment settlements to the world, whilst simultaneously solving a major problem for the US government.

They’re a pretty big deal.

Now I know decentralisation maxis and Bitcoin purists will attack me for this and say WTF IS WRONG WITH YOU, you can get basically all of those benefits just from holding Bitcoin, where you also get a truly censorship resistant asset? Why are you entrusting your savings with a centralised stablecoin that can freeze your assets just as easily as a bank account can?

I have a lot of sympathy for this take. But I think at least for now it’s overwhelmingly unlikely that Bitcoin ends up actually being used as a payment asset. People hold Bitcoin because they want to save it, they want to hedge against inflation, they specifically do not want to spend it. Merchants don’t want to accept it because it’s volatile. And rightly or wrongly, people all over the world really really value the US Dollar.

This is why you don’t see 400 million people across the world paying for stuff in Bitcoin, but you do have 400 million people using USDT.

So my mental model for this is, as a non-US person without FDIC banking protections, living in a country where at some point wealth confiscation may happen, or a banking bailout is likely, I would like to store my wealth in a few buckets.

BTC for long-term savings, US stock market exposure, stablecoins for day-to-day payments or to buy dips & the minimum viable amount of local currency needed to survive in an emergency fund.

This way you can have a mix of decentralised and centralised assets spread across a range of issuers so in the majority of terrible scenarios you are sufficiently horcrux'd and don’t end up entirely destitute.

Too far in either direction imo is very silly and more dangerous than good.

(this is of course super simplified, I’m not a financial advisor and literally am very dumb, pls don’t listen to me)

And when I talk about this method, it’s not like I’m explaining how I'd operate in a third-world country with a dictator in control on the brink of civil war. I’d also have this same mental model if I lived in Europe.

Anyway, as usual I’m getting distracted and not talking about the entire point of this post, which is - what happens when we have a chain purpose-built for stablecoins?

Today, the majority of the stablecoin supply exists on Ethereum, which is far too expensive and slow to be used as a payment network, whilst Tron has somehow found itself positioned as the main settlement layer, despite being HIGHLY centralised and also extremely expensive ($3+ for a send)

So, we have this revolutionary tech, that people have been trying to kill since forever, operating on very old and outdated blockchains, not optimised for stablecoin transactions whatsoever, and we still have nearly $250 billion dollars issued.

How high would the number get if we had chains that were purpose-built specifically for stablecoins?

David Sacks saying Trillions are possible

Trillions…?

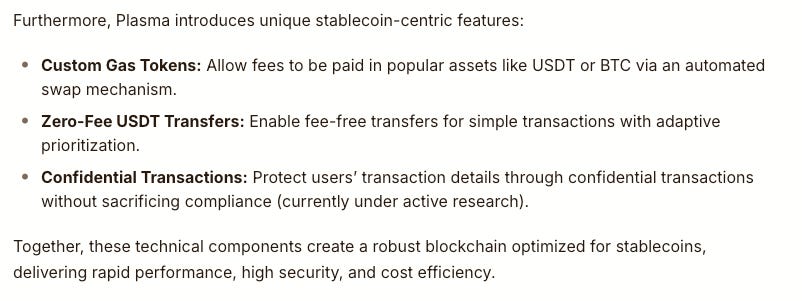

Which leads me to Plasma chain.

Plasma is a new chain that is purpose-built for stablecoins.

Now usually when teams invent these kinds of slogans, they’re really vague, and buzz wordy, and lack a lot of substance.

But Plasma is a bit different.

They are custom building the chain with unique stablecoin-specific features, including the core one - zero fee USDT transfers.

What this essentially means is that the cost to transact in USDT falls to zero, or very close to zero.

The user experience dramatically improves as you don’t need to have some random gas token on multiple chains in order to spend the assets. (e.g. solana, Tron, or having ETH on any one of 137 L2s) You can just use the USDT you were sent to pay the gas fee.

And at the same time Plasma is trying to figure out how to have confidential transactions on-chain. Which tbh is by far THE BIGGEST PROBLEM with stablecoins and crypto in general.

It kind of sucks if every time you try to buy some bread from the shop the dude selling it to you can paste your address into debank and see how much money you have, or that you’ve been cheating on him with a rival bakery. Not great.

On top of this, despite being EVM-compatible, Plasma is built as a Bitcoin sidechain and integrates a native bridge, whilst periodically committing state differences to Bitcoin itself.

So yeah, pretty cool imo.

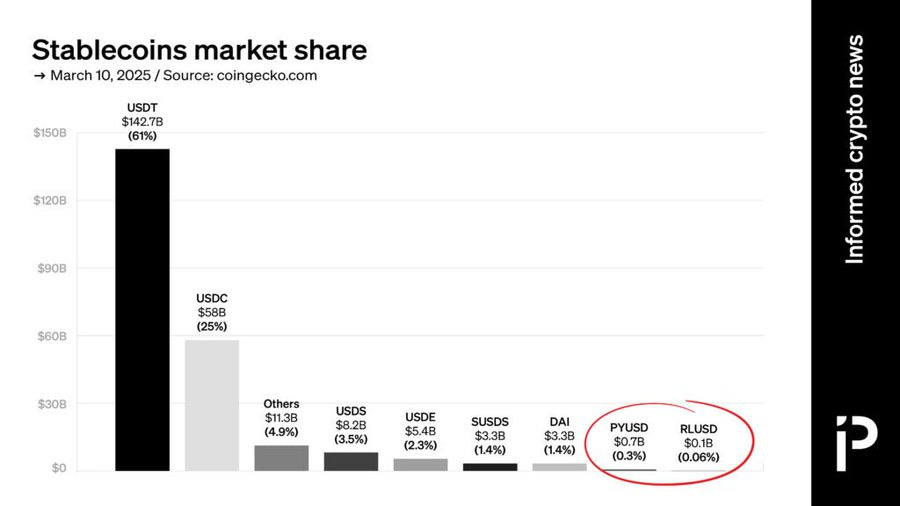

Now angry people will read this and tell me that Tether is a scam and I am stupid and shout - why would anyone use this when PayPal or Fidelity or the State of Wyoming are launching their own coins.

Or why wouldn’t stablecoins mostly just run on the rails of the new super-fast general purpose chains like Solana?

But I think this argument misses the bigger picture. Simply having a stablecoin, or a fast chain, is not enough. You need the track record. You need the adoption and willingness to have the asset accepted by merchants and by consumers. You need the network effects. You need the integrations with retailers and wholesalers and commodity markets.

Plasma targets this specifically by focusing on the two most widely known and accepted crypto assets, Bitcoin and USDT, and their roadmap focuses on adding stablecoin-specific features to make the user experience as good as possible.

I’m not sure web 2 teams, archaic banks or government institutions are best placed to capture this market, especially as the main use case is for international-trade, focused mainly outside of America.

There's a reason PayPal USD, despite having brand recognition and offering lots of incentives, still doesn’t have a billion dollars issued, and sits with only 0.6% of Tether's supply. A “trusted” brand name only goes so far.

Chart and article explaining this is linked below.

https://protos.com/paypal-and-ripple-stablecoins-still-sub-1-despite-stablecoin-gold-rush/

So yeah, this post is now WAY too long and I am currently very sick, so I will wrap it up here, despite having a Trillion more things to say.

DM me if you want to talk more about stablecoins, or think I've missed something obvious.

In summary,

Stablecoins are probably about to go nuts.

America has finally realised they are critical to the long-term economic interests of the country.

Imo it probably ends up in a winner-takes-most scenario.

Despite centralisation concerns the world is far better off with stablecoins than without them, but would also hold a variety of assets as a hedge.

A bold prediction is USD denominated stablecoins will be the main method of transacting in Europe within a decade, not the Euro.

Plasma is an interesting design choice, I like that it focuses on the core aspects of stablecoins whilst also embracing Bitcoin.

Privacy focus is crucial to the long-term sustainable adoption of stablecoins

Trillions is not just a meme

I pray for Plasma ICO

Remember, I am very dumb, do not listen to me, this is not financial advice, self custody is risky, stablecoins are risky, banks are risky, crossing the road is risky, cars are very risky, planes sometimes crash, bad things can happen, stay inside, never leave your computer, and enjoy your weekend.