A Happy take on the Shanghai Update and LSDs

A week in review 03

This year I’m committing to writing a short post at the end of each week about something interesting I've come across.

You might think its weird that the title of the first ever post is a week in review 03, and you would be correct. That’s because I’m a lazy person who missed the first two weeks of the year.

Nothing I write in this blog should be taken as any form of financial advice, I am an idiot who gets most things wrong and if you listen to me, you will definitely lose all of your money, immediately.

Source: Dalle2– sad looking person bcos poor

This week, my internet wanderings led me to focus on two topics: the re-emergence of the narrative around Liquid Staking Derivatives (LSDs) and the upcoming Shanghai update for the Ethereum blockchain.

What are these confusing sounding things?

LSDs, are not powerful hallucinogenic drugs. Instead, are magic code that allows for staking Ethereum tokens to earn yield. For example, staking ETH with Lido results in receiving stETH, which can then be used as collateral in other DeFi protocols such as AAVE.

The Shanghai update, scheduled for March, will enable the withdrawal of staked Ethereum.

If you are a normal human being who has not had their soul slowly sucked out of them due to an addiction to Crypto Twitter you are probably wondering what on earth this means. The truth is, I’m lazy and not smart enough to explain it.

As we approach the update, the amount of staked ETH has continued to climb.

Source: Dune dashboard – created by @Hildobby

So what does this mean.

Depending on who you follow on Crypto Twitter, as with almost any topic, you will either believe:

1) The sky is going to fall and the Ethereum blockchain will become a deserted wasteland as 16million Ethereum tokens become unlocked and are instantly market sold sending the price swiftly to $0.

2) It is the most bullish event since Satoshi himself published the Bitcoin whitepaper, and all ETH in existence will immediately become staked and 50% of total supply will be wiped from the face of the earth as ETH enters a hyperloop deflationary flywheel.

As usual, the outcome probably resides somewhere between these two extremes. Anyway, Here are a couple of interesting observations to consider:

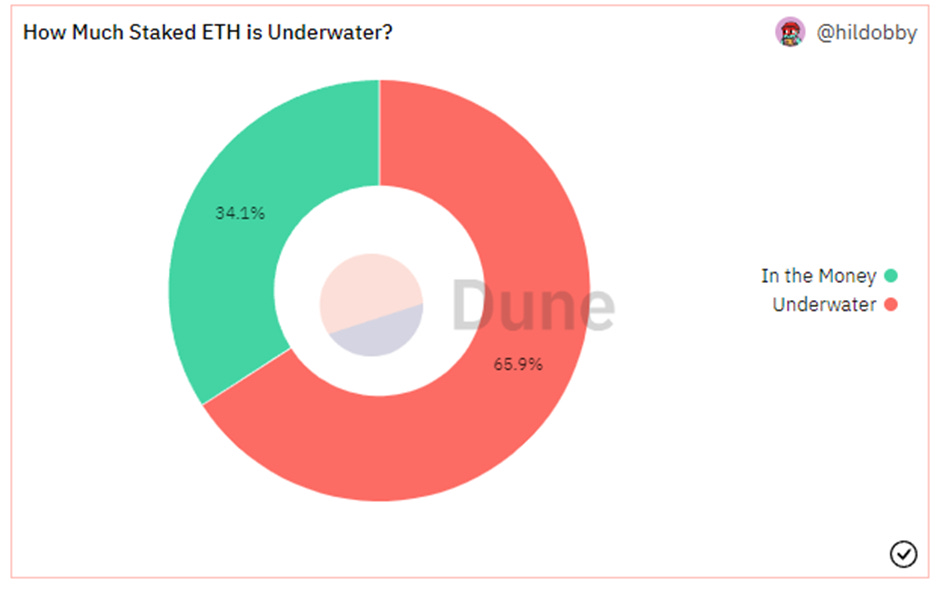

1) Most people who have staked ETH so far are holding underwater positions.

Source: Dune dashboard – created by @Hildobby

I’ll leave it to you to decide if these participants are more or less likely to sell than if the price was up?

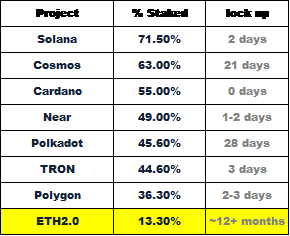

2) A relatively small percentage of total Ethereum tokens are currently staked. When compared to other major L1s, ETH has significantly less staked than other chains.

Source: Staked.us

One possible reason for the low percentage of staked ETH is that staking previously required taking on significant risk.

First of all you had to trust that the Merge would actually take place, and wouldn’t break everything.

On top of that you had the possibility of having coins locked on an exchange for an extended period of time and the risk of them being stolen, or you had to trust that new LSD providers such as Lido wouldn’t get hacked.

While Lido performed well during the bull market, there were periods of uncertainty, such as during the Luna and 3AC collapse, when stETH traded at a 7% discount to ETH. This caused some investors to panic and swap back to ETH, resulting in the loss of yield gains for the year.

Now the merge has been completed and once the Shanghai update allows for withdrawals, these risks will be reduced.

Source: https://thedefiant.io/steth-depeg

Even after the Shanghai update, it is possible that ETH may still lag behind other L1s in terms of staking volumes. This is because ETH has the most robust NFT ecosystem and the most trusted DeFi platforms. Put simply, there is more to do with ETH on ETH than there is on other L1s.

While LSD tokens have made significant efforts to gain composability within DeFi, there has yet to be any significant progress in utilizing them within the world of NFTs. I know some serious monetary minds see NFTs as an embarrassing sideshow within Crypto, but the use cases and user adoption cannot be ignored.

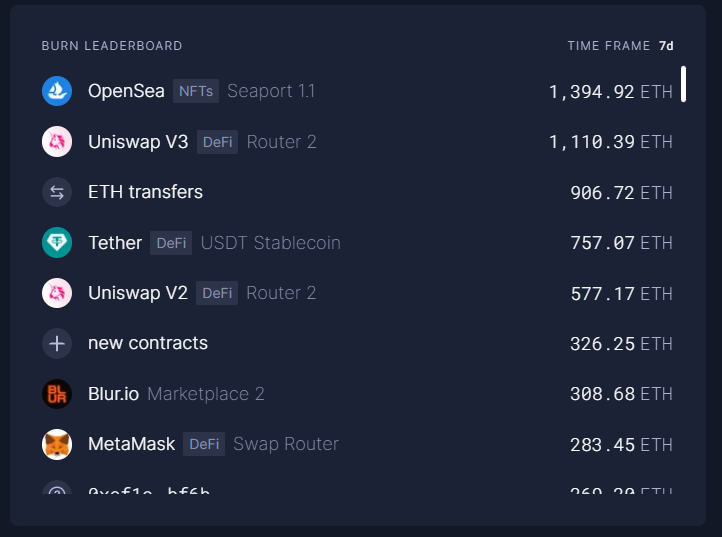

Popular NFT marketplaces like OpenSea and more recently Blur continue to top the ETH burn leaderboards. It is also easier for the average person to get excited about a lootbox-style opening of a picture of a monkey than it is about tokens named st-yCRV, lp-yCRV, and vl-yCRV.

It’s possibly unlikely that NFT users will be incentivised to stake, simply because Yolo-ing NFTs is more fun.

Here you can see OpenSea burns more ETH than Uniswap and Blur has overtaken MetaMask.

Source: https://ultrasound.money/

3) Metamask Finally adds staking integration

MetaMask is currently the most widely used crypto wallet, and their recent addition of direct integrations with LSD providers Lido and Rocketpool makes staking far more accessible and user-friendly. This also adds credibility to both providers by association with MetaMask's well-known and trusted brand. This could lead to more small-scale users beginning to stake their ETH.

Summary

In summary, my best guess for the post-Shanghai Ethereum market is that despite potential selling from underwater historic stakers, and crys of macro doom and gloom the percentage of ETH staked will continue to increase.

While I am not making any price predictions for ETH, there are a few broad and likely outcomes if my prediction is correct:

1) Increasing access to staking could lead to a short-term increase in ETH dominance, as users move out of altcoins and into ETH, attracted by the yield.

2) As the attention shifts to the LSD narrative around the time of the Shanghai update, it is possible that legitimate and illegitimate forks, copies, and ponzificated platforms may appear within the subset of LSDs. For example, whales could create a fork, stake their own ETH to appear legitimate, launch a token, and encourage deposits with airdrops. Or, new platforms could offer incentivized bonds where users lock their ETH with them for a time period and receive a new token in return.

3) This game probably lasts for a while and like everything in crypto, turns to complete stupidity. During this time liquidity could dry up in the NFT market as everyone races to stake and get the highest yield possible.

4) As more people stake, the yield will decrease and the short-term, gamified dog themed clones will start to collapse as they cannot retain users. People will lose interest in this narrative and move on.

5) The legitimate and well-run LSD providers will continue to see long-term growth even after the hype bubble subsides. A bold prediction for 2023 is that the LSD provider that is able to integrate with either OpenSea or Blur, and use LSD tokens in place of WETH bids will see more unique user adoption than integrating with the marginal DeFi platform.

As usual, I’m just a Happy idiot badly writing down my poorly thought through ideas, so It’s most likely all of the above predictions turn out to be very wrong. Please ignore everything you have just read and seek out someone smart. 😊 Alternatively, stop reading about this and go outside.